What are the root causes of the global economic crisis?

Authored by JP Orient

Abstract: This analysis argues that today's financial crisis is driven by computational heuristics, discoveries made by machines, to find logical rationales for maintaining moribund power structures. Rather than using computational heuristics to lead societies toward a world in which people desire to co-exist, the essay shows how vested interests have used machines to dictate and defend corroding centers of power. The result is an Imperium ex Nihilo, an "Empire Out of Nothing" but the assumptions of man inside the narrow focus of profit and greed.

Today's financial crisis can be analyzed through an array of lenses. In the narrowest, it is the capitulation of Keynesian economics to social conservatism emboldened by concentrated wealth. In the broadest, it represents lost trust in societies that delivered some of mankind's greatest social achievements: Enlightenment, Scientific Method, Democracy and Human Rights. Through an ecological lens we might see it as a resource-limitation shadow cast upon an ailing Earth. Militarily we may someday see the crisis as the product of imperial overreach. Commercially it could be scrutinized as a corporatist revolt, whereby organized interests overthrew the state in managing the world's tenuous plenty behind fortified castles of capital.

However history's kaleidoscope is used to see the crisis, it will be observed that the designers all used the same weapon in its proliferation: machines built to think for them.[1]

By focusing the lens on the tools of its making, today's financial crisis is seen as the betrayal of the promise that man-computer symbiosis once held. The betrayal is not wholly unexpected. Networked computing from the onset was funded and designed primarily as a tool for waging war. Its first civilian incarnation was conservative to the core. Banks used the innovation to preserve the profitability of accumulating ever more capital by reducing worker costs deployed to count wealth.

"We slaved in our underwear, in an un-air-conditioned bank vault, with an occasional six-pack of beer to make it more bearable. Every afternoon, we counted out billions of dollars of actual bond and stock certificates to be messengered to banks as collateral for overnight loans. Then, every morning, when those certificates needed for delivery to customers were returned by a group of disheveled old men who blanketed the streets of lower Manhattan carrying "bearer" bonds and stocks door-to-door, we checked them back into the firms inventory."[2]

That tale of squandered youth was written by a costly 24-year-old Harvard University MBA who toiled beneath the of boilers of Solomon Brother's in 1966. His name was Michael Bloomberg. Fortunately for him, one year earlier Bank of America had hired a 42-year-old German mathematician, whose family had escaped their country's Holocaust, to alleviate the burdens of young financiers by writing a computer program to help balance the books.

"There were many very hard technical problems. It was a whale of a lot of fun attacking those hard problems, and it never occurred to me at the time that I was cooperating in a technological venture which had certain social side effects which I might come to regret. That never occurred to me. I was totally wrapped up in my identity as a professional and besides, it was just too much fun."[3]

Joseph Weizenbaum, the artificial intelligence pioneer who created, what appeared to some, a sentient machine program, ELIZA, was later recognized for his warnings that technical innovations may come at the expense of social evolution. They prop-up decaying power. Michael Bloomberg saw profit through innovation, and when released from his Solomon bond in 1981 with a $10 million check, set off to rejuvenate moribund U.S. banking with network computing.

"I would start a company that would help financial organizations ... When it came to knowing the relative value of one security versus another, most of Wall Street in 1981 had pretty much remained where it was when I began as a clerk back in the mid-1960s: a bunch of guys using No. 2 pencils, chronicling the seat-of-the-pants guesses of too many bored traders. Something that could show instantly whether government bonds were appreciating at a faster rate than corporate bonds would make smart investors out of mediocre ones, and would create an enormous competitive advantage over anyone lacking these capabilities. At a time when the U.S. budget deficit (financed by billions of dollars of new Treasury bonds and notes) was poised to explode, such a device would appeal to everyone working in finance, securities and investments..."[4]

The young investment-banking Bloomberg realized his vision and today sits atop the world's financial capital, mayor of New York and owner of the highly valuable and systemically important company bearing his name. Weizenbaum spent the last 14-years of his life in Berlin after returning disillusioned from Cambridge, MA in 1996. His ideas were documented in a film, "Plug and Pray."[5]

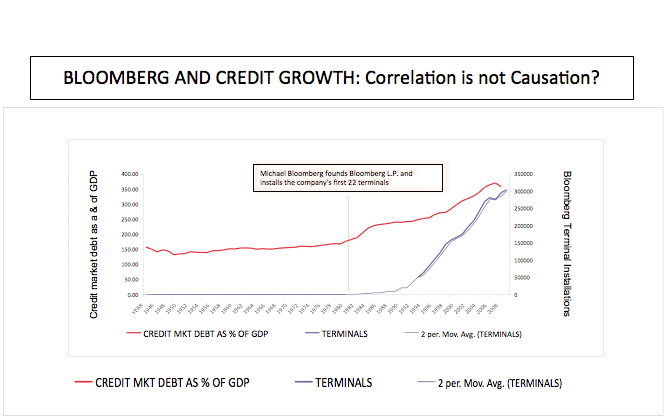

Source: U.S. Federal Reserve data and publicly available data on Bloomberg L.P. installations.

Bloomberg, along with other computer-aided trading and analytical networks that formed in the 1980s, benefited from more than expansionary U.S. fiscal policy. Computer processing-power costs fell, resulting in more machines inside of decision-making organizations. At the same time, computer scientists began to revolutionize software logic.

The science of heuristics -- problem-solving strategies using "rules of thumb" and intuitive guessing to detect patterns inside complex systems -- began to subsume deep modeling as a computational method to aid decision making. Whereas early network designers envisioned men using computers to deepen and refine meaning about well-understood systemic phenomena, new computational techniques ordered computers to detect patterns and meaning from seemingly incomprehensible data.[6]

Greece is ironically the etymological origin of the computational logic that financial networks tell us will be the country's ultimate demise. Heuristic is derived from the Greek word to "find" or "discover." Its root is most commonly illustrated with the story about the mathematician Archimedes who ran naked from his bathtub crying "Eureka" after solving a vexing problem. Heuristic problem-solving strategies use "fuzzy logic," "swarm intelligence" and "tabu search" algorithms. They are techniques that intuit patterns without complete information.

By the early 1980s the quintessentially human domain of seeing meaning inside the patterns of complex systems, had given way to "neural," "greedy random" and "adaptive" computer networks that identified the patterns for us. The supreme confidence in this new form of man-computer symbiosis can be glinted in the recorded tirade of Matthew Winkler, the young Wall Street Journal reporter Michael Bloomberg hired to become the public face for his financial network.

"No!" Winkler yells at a journalist who faulted a machine for an error in his reporting. "The enemy was not the computer. That's wrong. Excuse me! The enemy was not the computer. That's why we are having this meeting. I figured that a lot of you were going to think this way. It's wrong! It's not the computer, it's the human!"[7]

Caption: Mathew Winkler and Michael Bloomberg on the inside cover of "Bloomberg by Bloomberg," 1997.

Bloomberg, and similarly operated computer networks, publish the stories of machines rather than those of men. Their society has ceased to trust the discoveries, the heuristics, of man and instead turned to those calculated by machines. The result is a devastating cognitive dissonance that threatens the resiliency of societies, those patterns manifest by the fastest, deepest and most flexible processing capacity that, at times, graces the Earth: us.

Even the Defense Advance Research Project Agency, or DARPA, which funded the decades of basic research that created Internet Protocol, says that the new generation of U.S. tax-payer funded computers are a long distance from matching the human mind's raw processing power.

“We have no computers today that can begin to approach the awesome power of the human mind. A computer comparable to the human brain would need to be able to perform more than 38 thousand trillion operations per second and hold about 3,584 terabytes of memory. (IBM’s BlueGene supercomputer, one of the worlds’ most powerful, has a computational capability of 92 trillion operations per second and 8 terabytes of storage.)"[8]

It is well understood and acknowledged that languages written by man for computers necessarily contain the assumptions and biases of their authors. The "Subjective Expected Utility" model, which "defines the conditions of perfect utility-maximizing rationality in a world of certainty," has been central to economic dogma, according to a 1986 National Academy of Sciences report.[9] One of the fatal, utterly trod upon and discredited assumptions underlying virtually every financial-software heuristic is that men can be relied upon to make rational decisions.

We are reminded of the moment in "The Great Dictator" when Charlie Chaplin cries out to the soldiers "you are not machines!"[10] People experience shame. They feel guilt. They exercise compassion and love. People foment rebellion.

Our financial crisis is driven by computational heuristics, discoveries made by machines to find logical rationales for maintaining moribund power structures. Rather than using computational heuristics to lead us to a world where we want to live, societies have allowed machines to dictate and defend corroding and corrupt centers of power.

As an aside, it is noteworthy to observe how quaint the U.S. State Department cables released by Wikileaks look compared to the finance-driven headlines that define our present crisis. It is somehow touching the way U.S. public servants exercise humor, wit and drama to convey the humanity of actors balancing the scales of international order. Meta-word searches of the cables nevertheless do provide some insight into the direction our world is spinning:

The cables released by Wikileaks will keep the heuristic machines humming for a long time while they grind and churn new strategies to increase yield, extract rent, maximize profit and maintain power.

But what about the rest of us? Who among our elected leaders will speak clearly the human vision and show their guts, to man and woman alike, by exercising compassion? Who will program our machines to search for the elusive path leading to the place where peace and security overcome violence and mistrust?

Ours is an Imperium ex Nihilo, an "Empire Out of Nothing" but the assumptions of man inside the narrow focus of profit and greed. There are technical remedies that may temporarily ease the suffering that is a byproduct of machine-driven economic discoveries.[15] However in the end, we must start the long and arduous task of re-programming them to work for us, to help us see the patterns in the societies that we desire.

Our machine-made heuristics have been misappropriated. Rather than being used to minimize the risks men face in their time on Earth, they have been taken by a narrow band of craven elites who reap greater profit from the instability their discoveries sow. It is time for a clear voice human voice to say enough and bring us back into balanced alignment with our creations.

Let machine-made heuristics discover better ways to direct city traffic, guide craft in flight, and safeguard man's most deadly creation, nuclear weapons.[16]Grant them allowance to find efficiencies, safety and security. Computational heuristics can be powerful in the hands of men who know where they want to go. They are deadly inside the feckless culture of bullying that characterizes our financial institutions.

Wresting these most powerful tools of reasoning away from society's vested elites will not be easy but it is within reach. They will try to spin the counterforce of human progress against those who try. Fear. Hate. Intolerance. Nationalism. The vested elites who deploy computational heuristics, the discoveries of machines, to amass wealth have shown they are willing to support war, to turn their eyes to torture and bury habeas corpus when it is necessary to protected themselves. It will not be easy and it will not happen until humanity is exercised.

For inspiration and in parting, we might look no further than to the roots of networked computing, to the visionary JCR Licklider, who conceived of the Internet as we know it and dreamed of a day when:

"Unemployment would disappear from the face of the earth forever, for consider the magnitude of the task of adapting the network's software to all the new generations of computer, coming closer and closer upon the heels of their predecessors until the entire population of the world is caught up in an infinite crescendo of on-line interactive debugging."[17]

When at last our financial crisis is over and they finally come home, we should try to be kind to the underwear-clad bankers returning to toil by the boilers alongside the rest of us. May they bring beer.

------------------------------

[1] Technically, we may refer to these machines as "heuristically or meta-heuristically programmed computing networks"

[2] Bloomberg, Michael, "Bloomberg by Bloomberg," John Wiley & Sons, New York, 1997, page 23.

[3] ben-Aaron, Diana, "Weizenbaum examines computers and society," M.I.T.'s The Tech, Volume 105, Issue 16, April 9, 1985 (http://tech.mit.edu/V105/PDF/N16.pdf)

[4] Bloomberg, Michael, "Bloomberg by Bloomberg," pages 41-42.

[5] "Plug & Pray," 2010 http://www.imdb.com/title/tt1692889/

[6] For an exhaustive computational heuristics biography, Osman, Ibrahim H. & Laporte, Gilbert, " Metaheuristics: A bibliography" Institute of Mathematics and Statistics, University of Kent (http://sb.aub.edu.lb/PersonalSites/DrOsman/docs/Articles%20-%20pdf/BIBmh...)

For an example of applied computational heuristics, see: *Draft of *L. Ingber, M.F. Wehner, G.M. Jabbour, and T.M. Barnhill, “Application of statistical mechanics methodology to term-structure bond-pricing models,” *Mathl. Comput. Modeling *15 (11), 1991, pp. 77-98. (http://www.ingber.com/markets91_interest.pdf)

For a discussion of neural network application in finance, see: Wallace, Martin P., NEURAL NETWORKS AND THEIR APPLICATION TO FINANCE, Applied Technologies Centre, London, U.K. 2008 (http://www.saycocorporativo.com/saycoUK/BIJ/journal/Vol1No1/article_3.pdf)

For the definition of heuristics as a scientific discipline, see; Lenat, Douglas B., "The Nature of Heuristics," Xerox, Palo Alto Research Center, 1981 (http://www.bitsavers.org/pdf/xerox/parc/techReports/SSL-81-1_The_Nature_...)

[7] http://gawker.com/5002235/the-enemy-is-the-human

[8] Greenmeier, Larry, "Computers have a Lot to Learn from the Human Brain," Scientific American, March 10, 2009, http://www.scientificamerican.com/blog/post.cfm?id=computers-have-a-lot-...

[9] Simon, Herbert A.,"Decision Making and Problem Solving,"National Academy of Sciences, National Academy of Engineering, Institute of Medicine, 1986, http://www.nap.edu/openbook.php?record_id=911&page=19

[10] http://www.youtube.com/watch?v=QcvjoWOwnn4

[11] Http://www.cablegatesearch.net search for "war" on August 28, 2011 yielded 38,882 returns. The search for "peace" yielded 26,379 hits.

[12] Http://www.cablegatesearch.net search for "Chinese" on August 28, 2011 yielded 9,865; English yielded 9,417; Europe yielded 31,767; Asia yielded

18,957.

[13] Http://www.cablegatesearch.net search for "Democracy" on August 28, 2011 yielded 12,304; "Bank" yielded 26,877; "Human Rights" yielded 38,452;

"Gold" yielded 6,024.

[14] Http://www.cablegatesearch.net search for "Baseball" on August 28, 2011 yielded 247; "basketball" yielded 203; "rugby" yielded 34; "Soccer" yielded 918.

[15] This analysis does not endeavor to explore the remedies for fixing our financial crisis. For further study, UNCTAD has consistently recommended currency controls as a counter-weight to financial innovation (http://www.unctad.org/en/docs/tdr2010_en.pdf). The May 2010 "flash crash," resulting in the DJIA's biggest intraday drop, was triggered by automated, high-frequency trading programs which warrant regulatory scrutiny and oversight. At the very least, and in keeping with the spirit of the cooperative, deep-modeling that computers enable, the commands and assumptions embedded in heuristic trading algorithms should be made public through SEC or other filings. Finally, for a more traditional approach, increasing the marginal tax rate on the most highly-paid workers may encourage the physicists and computer scientists creating bank models to seek more worthwhile employment.

[16] Clarke, L.B. 1993. The Disqualification Heuristic: When do Organizations Misperceive Risk? Research in Social Problems and Public Policy 5:289-312.

[17] Licklider, JCR, "The Computer as a Communications Device," Science and Technology, 1968 (http://sloan.stanford.edu/mousesite/Secondary/Licklider.pdf)

Theme by Danetsoft and Danang Probo Sayekti inspired by Maksimer

man vs. machine

This essay reminds me of Oswald Spengler's classic book The Decline of the West, particularly Spengler's observation that the decay of the Western Empire was to be accompanied (perhaps precipitated?) by humanity's enslavement to machines. Nicely done, and congratulations!

computer programmer at a trading company

""I just feel incredibly lucky to be living now. What would I have been doing with my maths skills 100 years ago? Or 100 years from now? This is exactly the right time in history to have these skills. And I have them."

Anecdotally, to demonstrate the point http://www.guardian.co.uk/commentisfree/joris-luyendijk-banking-blog/201...

Thank you Joris Luyendijk at the Guardian

Exculpatory explanations

The trading and the traders, detailed in the article are no more than the mortar between the bricks of the market. This to some degree details the risks of rapid market movements which ordinary humans can never hope to counter. HFT is generally conducted with relatively small amounts across various securities attempting to take incremental profits on each trade. The losses and the profits are limited by the underlying asset pool and the amount of leverage employed.

What is not explained is large scale and broad based movements extending even across several markets. The “Hand of God” does seem to move the markets irrationally, but often “God” is exposed as having feet of clay and a very secular motive. The gods I speak of use a variety of tools at their disposal to manipulate market values.

These tools include:

-National and international figures whose pronouncements and decisions can be timed to create the desired market sentiment at a preplanned moment. (Very few market moving events are announced when the markets are not open.)

-Global or regional media manipulation of public opinions and perceptions. Even by shaping the public’s emotions in very subtle ways the market sentiment can be manipulated. The same few hands which provide ordinary people’s access to the markets also control the media and produce most of the other entertainments. I say “other entertainments”, because the markets have now taken that character. They no longer fulfill the requirements of commerce, they distract people from reality, and their behavior has an irrational and fictional aspect.

-And these same “Gods” also have the resources which allow them to also access the benefits of HFT. Persistent small trades in one direction will eventually catch the attention of the other HFT programs. These programs are written to trade in the direction of market sentiment and to sniff out and detect the slightest changes in this sentiment. In this manner relatively small amounts of money can be used to promote large market moves.

The traders detailed in the article probably have no agenda beyond making a bit of money on a daily basis by following trends, but when the same tools are employed by people who do have an agenda, the traders follow along. They don’t set the trends, they only react to them, and thereby reinforce the movement.

Into Nothing

This comment is very long, but it is not an attempt to sneak in a competition entry on the cheap, I realize that my writing is not of the same caliber as the very good entries in this month. What I would like is to offer an alternative view in to JP’s essay and also to the good essays on the causes of the economic crisis.

JP: Not out of nothing, but into nothing.

Not only money, but everything in our society is being debased. Money still buys stuff, but unless you have a huge amount of it all you can buy is Walmart garbage. Therein lies the problem. It isn’t only services like healthcare which have become two tiered but every aspect of our civilization. The discrepancy is so great that often we don’t even realize our disenfranchisement. It’s like standing in the slums of Calcutta trying to see the top of the Himalayas.

Money now means nothing. The only ones who think so are peasants and plebeians. Real wealth is to be like Ted Turner who personally owns enough land to rank larger than the next 100 countries and to have that land represent only a minor part of his wealth. Real wealth is owning 500,000 people though their dependence on the paycheques you provide, like the Waltons. Real wealth is the power of denying large numbers of lesser people access to basic necessities at a whim, like the United States has practiced on a global scale for fifty years. Real wealth has never been measured in dollars, but in power.

Attempting to right these imbalances by force is to fall into the envy trap and will only ensure the continuation of our historic abuse cycle. Nearly everyone would like to be wealthy. In a materially competitive world that is impossible. Material wealth is a relative concept. It is impossible for all to be either wealthy or poor simultaneously. The mean wealth could be less or more. But, so long as we grant status to material wealth, there will always be a range. Even those few who reject material and take vows of poverty are bowing to the God of Money.

Mankind needs to evolve. We need to develop the vision to value ourselves and our fellow human beings as being something greater than a potential dollar sign ($). So long as we can only see value in terms of what we have in relation to what all other people have, there will be a struggle and a competition to steal the wealth of others to improve our own score in the game.

If one can accept the fallacy of this idea, then it becomes obvious that stealing the riches of the wealthy by taxation or violence solves nothing. Presently 800 people own half the wealth of this world. Readers might think that redistributing this wealth would be a fine idea. But, consider that half the world’s population has never seen a computer screen (computers are rather expensive for those who live on $2 per day, or less.) Those people would also like to share the redistribution of the wealthy and a fair amount from internet surfers as well….A universal redistribution would not be a happy thing in a materially focused world.

We suffer from a lack of imagination. Rather than strive to make everyone richer, which is possible, we attempt to make ourselves richer at some other people’s expense. This reflects a destructive flaw in our characters and dooms our civilization to eternal conflict. Many are incapable of satisfaction or contentment. Many more, because of empty bellies and dying children will never have the chance for contentment.

The sole justification for redistribution is to prevent hunger. That is as far as it should ever go. For Global justice beyond that we need to end policies of intentional denial and we need to reset the financial structure in such a manner that force may not be used in the collection of debts and interests.

well done

This is brilliant. You have a great perspective on standing outside the machines watching and understanding how they work. I just to like to believe that most who are perpetuating the crisis are ignorant of the wrongs, and believe it's all 'working' or they can make it work. Now I believe they are well aware and really do not care, but have become brilliant at giving the guise of care.

Well done JP Orient.